sales tax on food in memphis tn

Please click on the links to the left for. Get rates tables What is the sales tax rate in Memphis Tennessee.

County Administration Building 160 N Main Street Memphis TN 38103 Phone.

. Memphis TN Sales Tax Rate. Memphis is located within Shelby County. The current total local sales tax rate in Memphis TN is 9750.

Reductions may include 0-15 tax on water depending on use and 0-15 on gas electricity and various energy sources depending on use. You saved on clothes and electronics now you can save on food. 519 PM CDT August 2 2021.

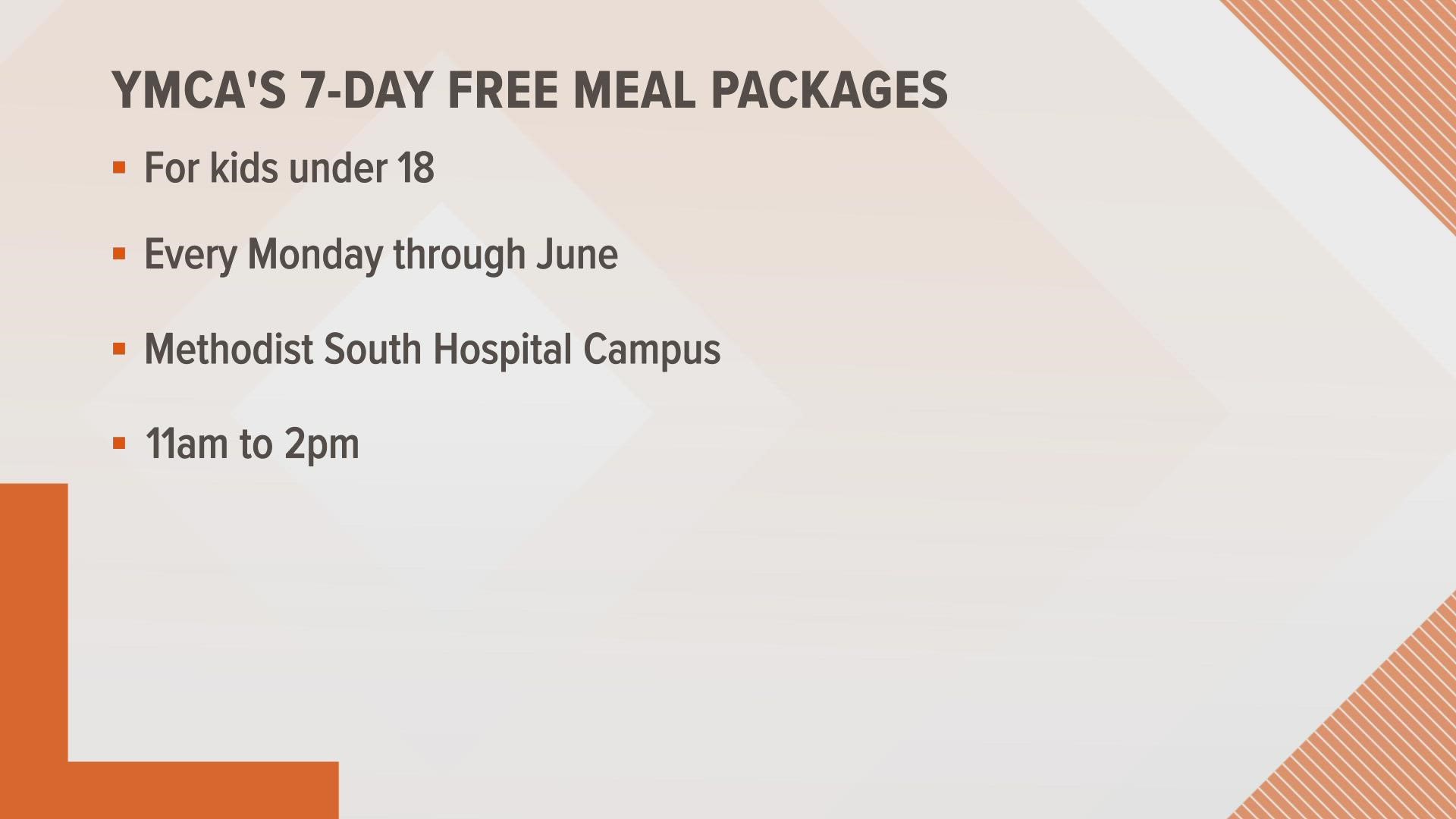

The local tax rate varies by county andor city. The minimum combined 2022 sales tax rate for Memphis Tennessee is. Starting Monday Tennessee shoppers wont have to pay any taxes when they buy food at the grocery store.

Sales tax exemption for. With local taxes the total sales tax rate is between 8500 and 9750. The general state tax rate is 7.

The 975 sales tax rate in memphis consists of 7 tennessee state sales tax 225 shelby county sales tax and 05 memphis tax. Counties and cities can charge an additional local sales tax of up to 275 for a. The sales tax is comprised of two parts a state portion and a local portion.

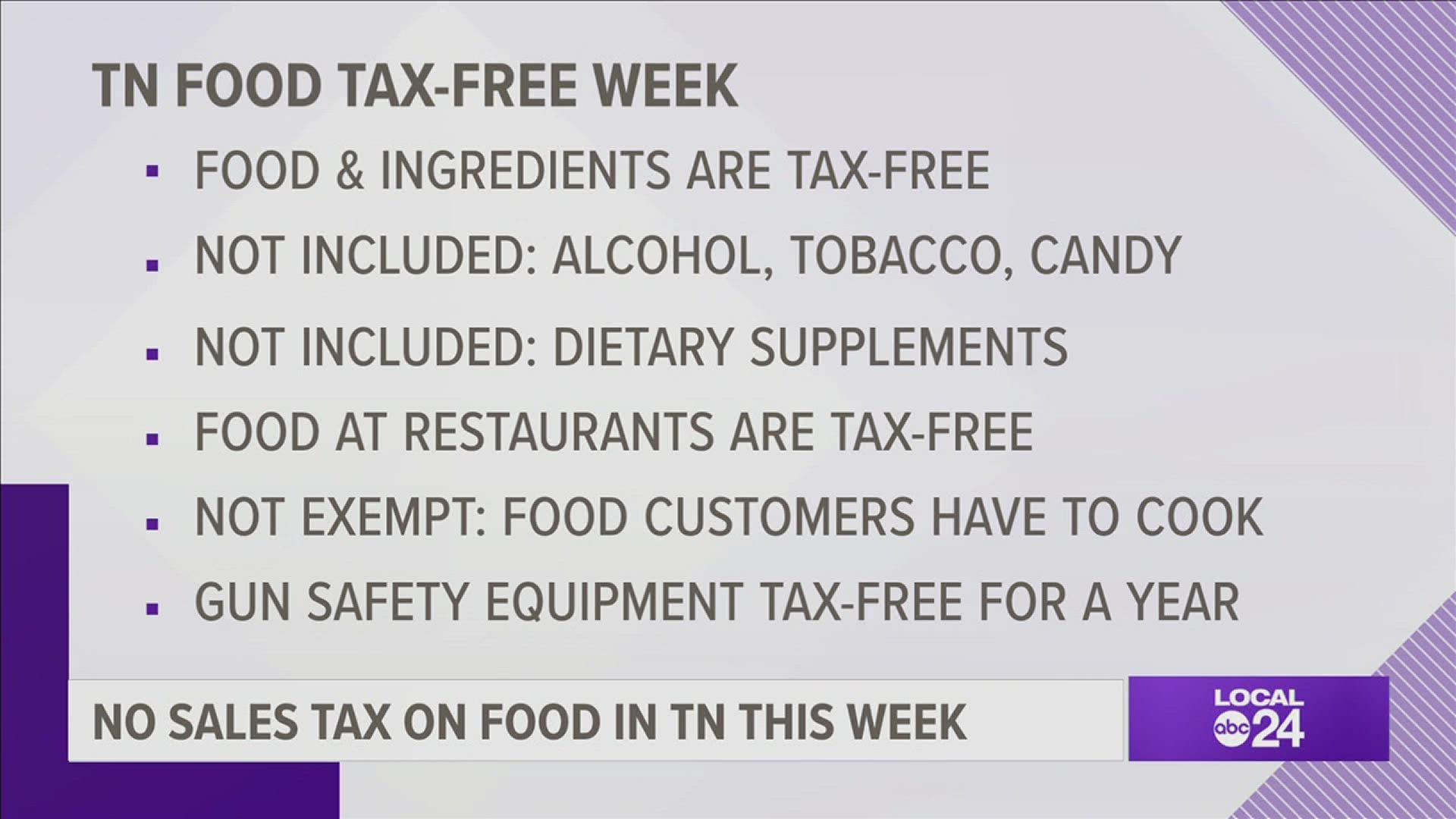

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Tennessee. The grocery sales tax suspension holiday. According to the Tennessee Department of Revenue the sales tax rate on food is 4.

This is the total of state county and city sales. 1 Tennessees Sales Tax Holiday on food saved Memphians nearly 7 on their groceries or 675 for every 100. The first-ever sales tax holiday on grocery and.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 21950 for a 20000 purchase. The December 2020 total local sales tax rate was also 9750.

These foods are packaged or in their original form and not prepared or served as a ready-to. This includes the rates on the state county city and special levels. Tennessee TN Sales Tax Rates by City The state sales tax rate in Tennessee is 7000.

The average cumulative sales tax rate in Memphis Tennessee is 974. Memphis collects the maximum legal local sales tax The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

No Grocery Tax Suspension Until August But Here S Help Now Localmemphis Com

Best Big And Tall Chairs Office Chairs Big Man Chair Free Shipping No Sales Tax Some States Executive Office Chairs Office Chair Leather Dining Room Chairs

Tennessee To Suspend Sales Tax On Food In August Tennessee Star

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Groceries Are Tax Free In Tennessee During The Month Of August Localmemphis Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Small Business Guide Truic

Tennessee Sales Tax Holidays Offer Opportunities To Save The Courier

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

How Does The 2022 Sales Tax Holiday Work For Restaurants Bars Breweries And Distilleries Last Call Adams And Reese Llp

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Use Tax Guide Avalara

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tn Ms Shoppers Excited About Sales Tax Holiday Weekend For Back To School Amid Rising Prices Youtube

2022 Tennessee Sales Tax Holiday For Food Food Ingredients Clarksville Online Clarksville News Sports Events And Information

Tennessee Sales Tax Holidays What You Need To Know Wbbj Tv

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue